Understanding Dailypay: Revolutionizing Employee Payment Systems

Dailypay is transforming the way employees receive their wages, making financial stability more accessible for workers across various industries. This innovative payment system allows employees to access their earned wages before the traditional payday, offering them greater control over their finances. In this article, we will explore the concept of Dailypay, its benefits, and how it is reshaping the employment landscape.

The increasing demand for flexible pay options reflects the changing needs of the modern workforce. Traditional pay schedules often leave employees in precarious positions, waiting for weeks to access their hard-earned money. Dailypay addresses this issue by providing a solution that not only benefits employees but also employers, improving retention and job satisfaction. Throughout this article, we will delve deeper into the mechanics of Dailypay, its advantages, and its impact on both employees and organizations.

By the end of this article, readers will have a comprehensive understanding of Dailypay, including its features, market trends, and how it can be implemented in various business models. We will also provide insights into the future of wage payments and how technology plays a crucial role in this evolution.

Table of Contents

- What is Dailypay?

- How Dailypay Works

- Benefits of Dailypay

- Dailypay vs Traditional Payment Systems

- Who Can Benefit from Dailypay?

- Case Studies: Successful Dailypay Implementations

- The Future of Dailypay

- Conclusion

What is Dailypay?

Dailypay is a financial technology platform that enables employees to access their earned wages before the standard payday. This service aims to alleviate the financial stress workers often experience due to lagging pay schedules. By allowing employees to withdraw a portion of their earned income when needed, Dailypay promotes financial wellness and can reduce dependence on high-interest loans and credit cards.

Founded in 2015, Dailypay has gained recognition for its innovative approach to payroll systems. The platform allows employees to track their earnings in real-time, providing them with a clear understanding of their financial situation. This transparency empowers users to make informed decisions about their spending and saving habits.

Key Features of Dailypay

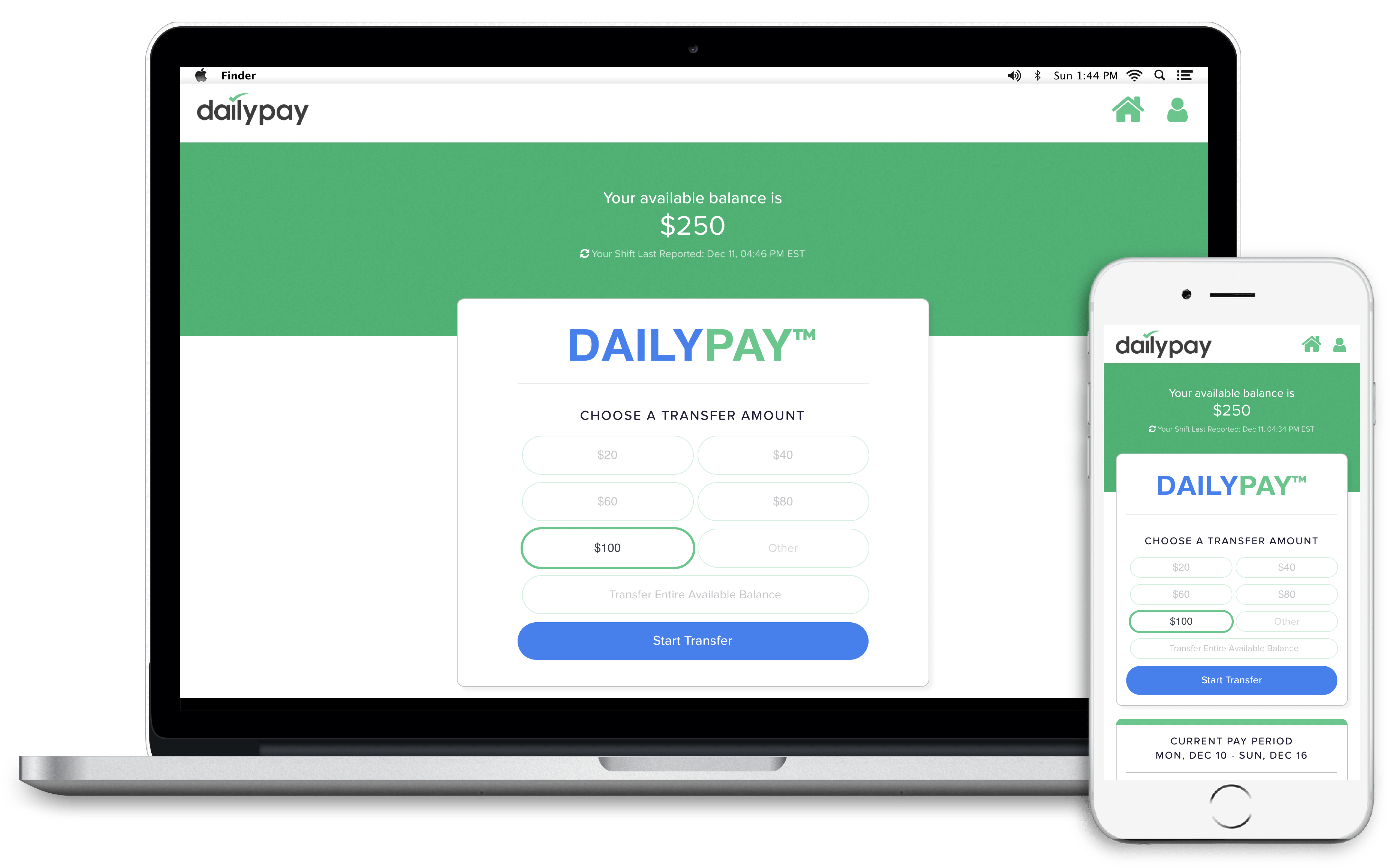

- Real-time earnings tracking

- Instant access to earned wages

- User-friendly mobile app

- Integration with existing payroll systems

How Dailypay Works

Dailypay operates by calculating an employee’s earned income daily. When an employee completes their work shift, the platform updates their available balance, allowing them to access a portion of their wages immediately. The process is simple and straightforward:

- Employee completes a work shift.

- Dailypay calculates the earned wages based on hours worked.

- Employee requests to withdraw a portion of their earnings.

- Funds are transferred to the employee’s bank account or debit card.

Employers benefit from this system as well, as it can lead to increased employee satisfaction and retention. By offering Dailypay, companies can position themselves as attractive workplaces, appealing to a workforce that values financial flexibility.

Benefits of Dailypay

The advantages of implementing Dailypay into the workplace extend beyond mere convenience. Here are some key benefits:

1. Improved Financial Wellness

Employees who have access to their earned wages can better manage their financial obligations, reducing stress and enhancing overall well-being. This access can prevent the need for high-interest loans or credit card debt.

2. Increased Employee Retention

Companies that adopt Dailypay often see improved staff retention rates. Employees appreciate the flexibility and control over their finances, leading to higher job satisfaction.

3. Enhanced Recruitment Efforts

Offering Dailypay can set employers apart in competitive job markets. Candidates are more likely to choose a company that provides innovative payment solutions and prioritizes employee welfare.

Dailypay vs Traditional Payment Systems

Traditional payment systems typically follow a bi-weekly or monthly schedule, which can create financial strain for many employees. Dailypay, on the other hand, allows for immediate access to earned wages. Here are some comparisons:

- Flexibility: Dailypay offers flexibility in accessing funds, while traditional systems do not.

- Financial Stress: Dailypay helps reduce financial stress, while traditional systems often contribute to it.

- Employee Satisfaction: Companies using Dailypay report higher employee satisfaction compared to those using traditional payment methods.

Who Can Benefit from Dailypay?

Dailypay is not limited to specific industries; it can benefit a wide range of sectors. Here are some examples:

1. Retail and Hospitality

Employees in retail and hospitality often work irregular hours and may face financial challenges between pay periods. Dailypay provides them with the flexibility they need.

2. Gig Economy Workers

Freelancers and gig workers can significantly benefit from Dailypay, as they often deal with inconsistent income streams. This service allows them to manage their finances more effectively.

3. Healthcare Professionals

Healthcare workers often face long hours and demanding schedules. Dailypay can help them access their earnings when needed, improving their financial stability.

Case Studies: Successful Dailypay Implementations

Numerous companies have successfully integrated Dailypay into their payroll systems. Here are some notable case studies:

1. A Major Retail Chain

A prominent retail chain implemented Dailypay and reported a 25% decrease in employee turnover within the first year. Employees expressed greater satisfaction with their financial situation, leading to a more motivated workforce.

2. A Leading Restaurant Group

A well-known restaurant group adopted Dailypay and saw a 40% reduction in late shift call-outs. The ability to access earned wages improved employee morale and reliability.

The Future of Dailypay

The future of Dailypay appears promising as more companies recognize the importance of flexible payment solutions. As technology continues to advance, we can expect further innovations in this sector, including:

- Integration with more financial health tools

- Enhanced user experience through mobile platforms

- Expansion into new industries and markets

Conclusion

Dailypay is revolutionizing the way employees access their wages, offering numerous benefits for both workers and employers. By allowing employees to access their earned income before payday, Dailypay promotes financial wellness, satisfaction, and retention. As the demand for flexible payment options continues to grow, it is likely that we will see more companies adopt this innovative solution.

We encourage you to share your thoughts on Dailypay in the comments below. If you found this article helpful, consider sharing it with others who may benefit from this information. Explore our website for more articles on financial innovations and employee welfare.

Thank you for reading, and we look forward to welcoming you back for more insightful content!

Backmarket: The Ultimate Destination For Refurbished Electronics

Exploring The Rise Of Damien Priest: WWE Superstar

David Goggins: The Unbreakable Spirit Of A Modern-Day Warrior